Business

Investors in the London Stock Exchange Group (LON:LSEG) have seen notable returns of 73% over the past five years

When we invest, we typically look for stocks that outperform the market average. And while active stock picking carries risks (and requires diversification), it can also provide excess returns. For example, long-term investing London Stock Exchange Group plc (LON:LSEG) shareholders have enjoyed a 63% rise in the share price over the last five years, which is much more than the market decline of around 0.6% (excluding dividends). However, more recent returns have not been as impressive, with the stock returning just 14% over the last year, including dividends.

It is now worth looking at the fundamentals of the business as well, as this will help us assess whether the long-term return to shareholders has matched the performance of the underlying business.

Check out our latest analysis for London Stock Exchange Group

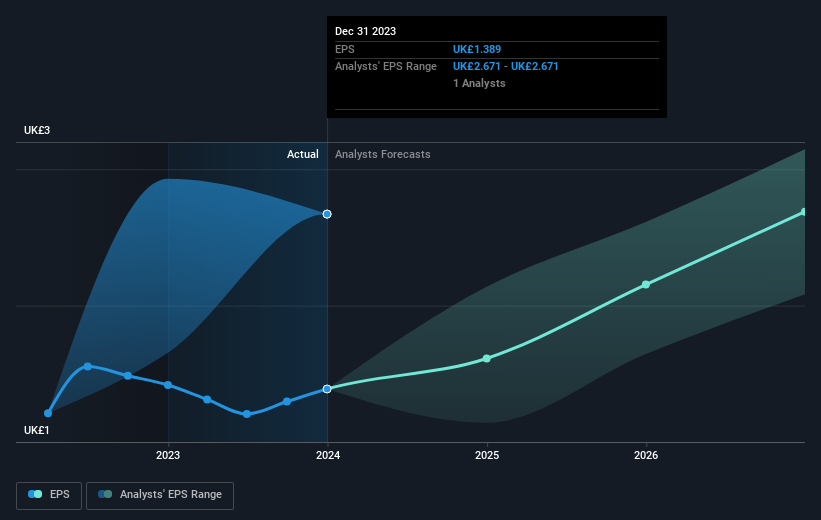

In his essay Graham and Doddsville Superinvestors Warren Buffett explained that stock prices do not always rationally reflect the value of a company. By comparing earnings per share (EPS) and the change in stock price over time, we can get an idea of how investors' attitudes toward a company have changed over time.

During the five years of share price growth, the London Stock Exchange Group has recorded compound earnings per share (EPS) growth of 0.7% per year. This EPS growth is slower than the share price growth, which was 10% per year, over the same period. This suggests that market participants have been holding the company in high regard of late. And this is hardly surprising given its growth history. This optimism is visible in its fairly high price-to-earnings ratio of 64.35.

You can see how EPS has changed over time in the image below (click on the graph to see the exact values).

Before buying or selling a stock, we always recommend a careful review of historical growth trends, available here.

What about dividends?

When looking at investment performance, it is important to consider the difference between Total return to shareholders (TSR) and stock price performance. While the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any capital raising or discounted spin-off. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. As it happens, the London Stock Exchange Group's TSR for the last 5 years was 73%, which is higher than the share price return mentioned above. And it's no prize for guessing that dividend payments explain a large part of the divergence!

A different perspective

We are pleased to report that London Stock Exchange Group shareholders have received a total return of 14% over one year. And that includes the dividend. That is better than the 12% annualised return over half a decade, implying that the company has been performing better recently. Given that share price momentum remains strong, it might be worth taking a closer look at the stock, lest we miss an opportunity. I find it very interesting to look at share price over the long term as an indicator of business performance. But to really get a sense of it, we also need to consider other information. For example, we have identified 1 warning signal for the London Stock Exchange Group which you should be aware of.

We'll like London Stock Exchange Group more if we see some big insider buying. In the meantime, take a look at this free list of undervalued stocks (mainly small caps) with significant and recent insider buying.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently traded on UK stock exchanges.

Do you have any comments on this article? Are you concerned about its content? Get in touch with us directly. You can also send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to constitute financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. Our goal is to provide you with focused, long-term analysis based on fundamental data. Please note that our analysis may not factor in the latest price-sensitive company announcements or qualitative information. Simply Wall St has no position in any of the stocks mentioned.

Do you have any comments on this article? Are you concerned about its content? Get in touch with us directly. You can also send an email to [email protected]

|

Sources 2/ https://finance.yahoo.com/news/investors-london-stock-exchange-group-060531790.html The mention sources can contact us to remove/changing this article |

What Are The Main Benefits Of Comparing Car Insurance Quotes Online

LOS ANGELES, CA / ACCESSWIRE / June 24, 2020, / Compare-autoinsurance.Org has launched a new blog post that presents the main benefits of comparing multiple car insurance quotes. For more info and free online quotes, please visit https://compare-autoinsurance.Org/the-advantages-of-comparing-prices-with-car-insurance-quotes-online/ The modern society has numerous technological advantages. One important advantage is the speed at which information is sent and received. With the help of the internet, the shopping habits of many persons have drastically changed. The car insurance industry hasn't remained untouched by these changes. On the internet, drivers can compare insurance prices and find out which sellers have the best offers. View photos The advantages of comparing online car insurance quotes are the following: Online quotes can be obtained from anywhere and at any time. Unlike physical insurance agencies, websites don't have a specific schedule and they are available at any time. Drivers that have busy working schedules, can compare quotes from anywhere and at any time, even at midnight. Multiple choices. Almost all insurance providers, no matter if they are well-known brands or just local insurers, have an online presence. Online quotes will allow policyholders the chance to discover multiple insurance companies and check their prices. Drivers are no longer required to get quotes from just a few known insurance companies. Also, local and regional insurers can provide lower insurance rates for the same services. Accurate insurance estimates. Online quotes can only be accurate if the customers provide accurate and real info about their car models and driving history. Lying about past driving incidents can make the price estimates to be lower, but when dealing with an insurance company lying to them is useless. Usually, insurance companies will do research about a potential customer before granting him coverage. Online quotes can be sorted easily. Although drivers are recommended to not choose a policy just based on its price, drivers can easily sort quotes by insurance price. Using brokerage websites will allow drivers to get quotes from multiple insurers, thus making the comparison faster and easier. For additional info, money-saving tips, and free car insurance quotes, visit https://compare-autoinsurance.Org/ Compare-autoinsurance.Org is an online provider of life, home, health, and auto insurance quotes. This website is unique because it does not simply stick to one kind of insurance provider, but brings the clients the best deals from many different online insurance carriers. In this way, clients have access to offers from multiple carriers all in one place: this website. On this site, customers have access to quotes for insurance plans from various agencies, such as local or nationwide agencies, brand names insurance companies, etc. "Online quotes can easily help drivers obtain better car insurance deals. All they have to do is to complete an online form with accurate and real info, then compare prices", said Russell Rabichev, Marketing Director of Internet Marketing Company. CONTACT: Company Name: Internet Marketing CompanyPerson for contact Name: Gurgu CPhone Number: (818) 359-3898Email: [email protected]: https://compare-autoinsurance.Org/ SOURCE: Compare-autoinsurance.Org View source version on accesswire.Com:https://www.Accesswire.Com/595055/What-Are-The-Main-Benefits-Of-Comparing-Car-Insurance-Quotes-Online View photos

to request, modification Contact us at Here or [email protected]