Business

If you want to get rich with marijuana stocks, you need to know the crucial difference between US and Canadian businesses.

The marijuana business is rightly described as an infant industry. But what investors see as a potential promised land may be farther away than many think, as full federal legalization can take a long time.

The ongoing legalization of marijuana in US states makes it a complicated and potentially lucrative space for investors. Most marijuana ETFs are passively managed, which means they follow indexes.

The following discussion highlights a benefit for active managers of exchange traded funds who can adapt strategies as the legal landscape changes.

Meanwhile, investors are better off rethinking their focus on Canadian cannabis companies, some of which may be excluded from much of the industry’s action. The devil is in the details.

For broad coverage of the vibrant marijuana industry, see Cannabis Watch.

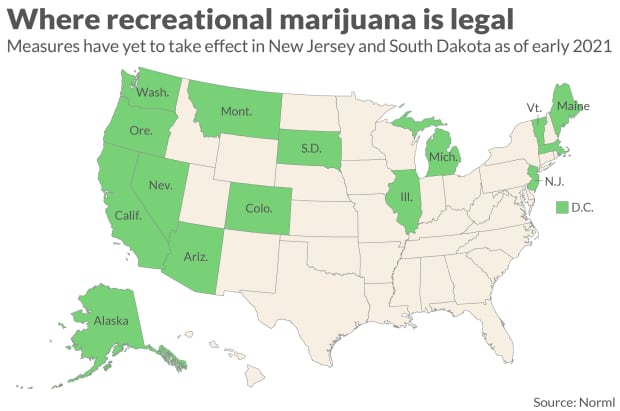

Marijuana has been legalized for recreational use in 15 US states and Washington, DC, however, it remains illegal at the federal level. This led to a bizarre scenario.

Licensed Canadian Producers (known as LPs) do not sell cannabis products in the United States because it is against US law. But the shares of the Big Five are listed on the Nasdaq Stock Exchange or the New York Stock Exchange:

Don’t miss: To take advantage of planned Tilray and Aphria merger, buy Aphria, analyst says

Meanwhile, the top four U.S. companies selling marijuana products in states (and Washington DC) where recreational use is legal are not listed on the US stock exchanges because they are engaged in activities that are technically illegal at the federal level. They are listed on the counter. These companies are called multi-state operators (MSOs):

In an August 2013 memorandum to American lawyers, now known as Cole Memo, James Cole, the then Deputy Attorney General, defined the Judges Department’s position as relying on states that had legalized recreational marijuana to put in place regulatory regimes to ensure compliance of the eight DOJ objectives listed on the first and second pages of the document.

Since then, the federal government has not attempted to arrest people in those states for purchasing small amounts of recreational marijuana.

But under the Investment Company Act of 1940, mutual funds and exchange-traded funds are still not allowed to hold shares of MSOs.

AdvisorShares managed to get around this problem by purchasing MSO equity total return swaps in AdvisorShares Pure Cannabis ETF YOLO,

and the AdvisorShares Pure US Cannabis ETF MSOS,

The Securities and Exchange Commission has asked AdvisorShares to obtain an external legal opinion on total return swaps, which you can read on the AdvisorShares website. You should also read the prospectuses of YOLO and MSOS if you are considering investing in them to learn more about their investment methodologies and risks, just as you should read the prospectus of any other mutual fund or ETF you are considering. .

Dan Ahrens, the portfolio manager of YOLO and MSOS, said in an interview on February 12 that he does not expect Canadian LPs to be able to sell marijuana in the United States in a foreseeable future, because neither Democrat-controlled Congress nor President Biden have ever called for full federal legalization of marijuana.

This is where the arguments begin.

It is easy for a politician to say that he or she wants marijuana decriminalized for recreational purposes in small amounts. But it’s not full legalization, which, in addition to allowing the recreational use of marijuana throughout the United States, would allow banks to provide full services to American producers and distributors of marijuana and allow their shares to be listed on public exchanges.

Full legalization would also likely open up the US market to Canadian LPs.

Ahrens therefore expects state-by-state legalization to continue, with MSOs being the biggest beneficiaries. He believes that Canadian limited partnerships are also worth investing, which is why YOLO owns shares of them. Canopy Growth Corp. is 38.6% owned by Constellation Brands Inc. STZ,

beer brewer Corona and Modelo, which owns many other well-known consumer brands and holds warrants enabling it to take a controlling stake in Canopy.

This gives Canopy deep pockets, the company has an agreement with Acreage Holdings Inc. ACRHF,

another US MSO, through which Canopy would acquire Acreage Holdings in the event of changes in US federal law to permit the general cultivation, distribution and possession of marijuana or to remove the regulation of such activities from state federal laws- United. This language comes from page 9 of Canopys 10k report for its fiscal year ended March 31, 2020.

MSOs already have a larger activity

Here’s a comparison of the sales data for the past four quarters for the five LPs and four MSOs. Corporate tax quarters are not uniform, so the update date for the most recent quarter data that was available from FactSet on February 18 is in the far right column.

The most recent quarter is marked Q0, the previous quarter is Q-1, and so on. All data in all tables are in millions of US dollars.

First, Canadian LPs:

Scroll through the table to see all the data. For four quarters, the five LPs achieved combined revenue of $ 1.284 billion, up 24% from the previous four-quarter period. If we divide the combined market cap of $ 33.785 billion by the sales of the past four quarters, the trailing price-to-sales ratio for the group is 26.3.

And now the American MSOs:

Again, you will need to scroll down the table to see all of the data. For four quarters, the five MSOs achieved combined revenues of $ 1.715 billion, an increase of 163% over the previous four-quarter period. If we divide the combined market cap of $ 21.862 billion by the sales of the past four quarters, the ending price-to-sales ratio for the MSO group is 12.7

Thus, MSOs grow their sales much faster and have a much lower sales valuation.

Maybe the difference in valuation shouldn’t be such a surprise. MSOs are traded over-the-counter only. Individual investors should therefore do their utmost to invest in them, or opt for YOLO or MSOS ETFs.

Here’s another dataset, this time comparing the net cash from operating activities of the two groups.

First, Canadian LPs:

Even though Tilray announced its fourth quarter results on February 17, the above cash flow information for the company is only through September 30. This is because the February 17 report did not include a statement of cash flows.

LPs as a group had negative operating cash flow for all periods, according to data from FactSets.

And now the American MSOs:

MSOs as a group recorded positive operating cash flow for three of the four quarters and for all four quarters combined.

A counter-argument

YOLO and MSOS are actively managed. The only other actively managed cannabis ETF is the CNBS Amplify Seymour Cannabis ETF,

You can read more about CNBS here.

In an interview on Feb. 17, Tim Seymour, the portfolio manager of CNBS, said that AdvisorShares has done a good job of building a business where they have the capacity to invest in companies that I would like to own.

He also said Amplify took a more conservative approach when forming CNBS in July 2019 because the SEC did not issue a general ruling allowing mutual funds or ETFs to invest in yield swaps. total MSO.

In addition to managing CNBS, Seymour is a member of the investment committee of JW Asset Management, a $ 2 billion hedge fund focused on the cannabis industry.

I invest in companies that I believe represent the best investor exposure for the best returns right now, Seymour said. He also stressed the importance of active management of space.

He agrees with Ahrens on the importance of the US market, especially if and when Congress fully legalizes marijuana and allows financial services companies to treat the industry as it would any other legal industry.

Canopy Growth Corp. is CNBS’s largest stake and Seymour cited the Acreage Holdings deal as an example of how a very well-funded Canadian LP can be instantly transformed into a major US player with full legalization.

In a February 16 interview, Christian Magoon, CEO of Amplify ETF, said CNBS was the top performing US ETF from 2021 to February 15, excluding reverse and leveraged ETFs. He also said the company was actively exploring the possibility that CNBS could invest in derivative securities.

It is therefore possible that at some point, CNBS will also invest indirectly in MSOs.

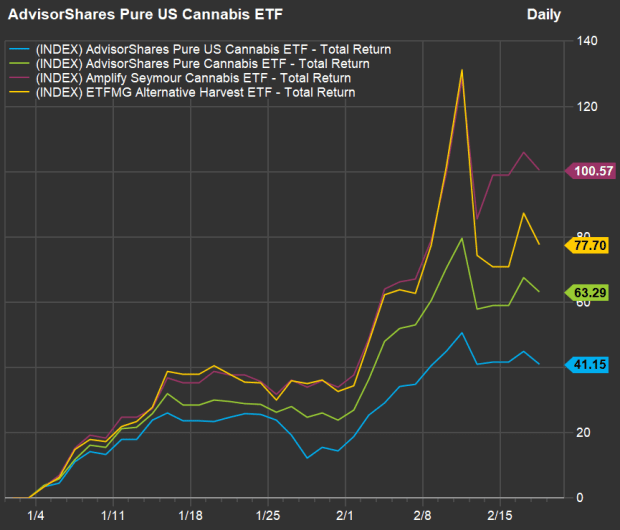

Actively Managed Cannabis ETF Returns

Here is a comparison of the total returns of the three actively managed ETFs, as well as the Alternative Harvest ETF MJ ETFMG,

which is passively managed and is the oldest cannabis ETF.

(FactSet)

All of them have made spectacular bullish moves this year, but you can see CNBS doubled, followed by MJ and the two AdvisorShares ETFs.

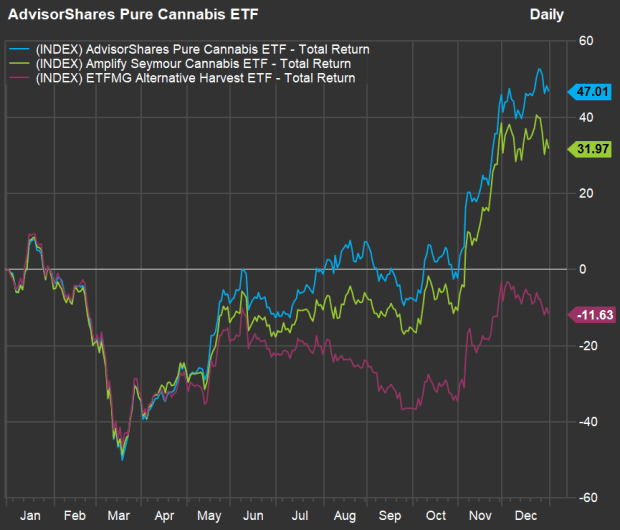

The AdvisorShares Pure US Cannabis (MSOS) ETF was created in September 2020. The following chart therefore compares the total returns of the other three ETFs in 2020:

(FactSet)

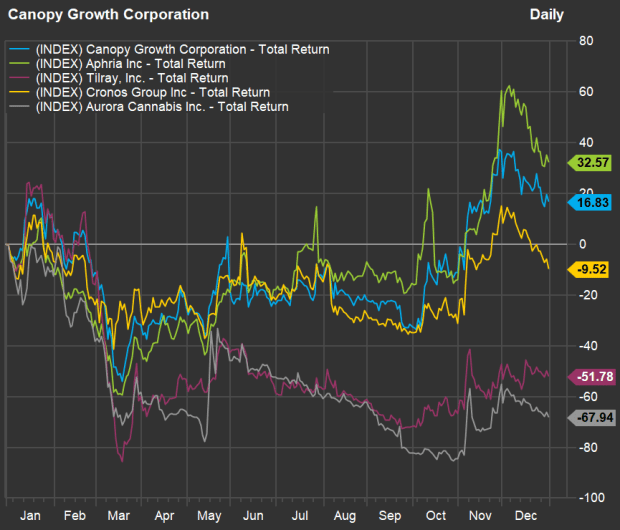

So last year YOLO, which owns MSOs as well as LPs, performed the best, while MJ’s passive approach underperformed. YOLO and CNBS both delivered significant returns, even though all five LPs were blended, with sharp drops for Tilray and Aurora Cannabis shares:

(FactSet)

Don’t miss: I am looking for a cannabis friendly red trend state with no income tax, where should I retire on $ 60,000 per year?

What Are The Main Benefits Of Comparing Car Insurance Quotes Online

LOS ANGELES, CA / ACCESSWIRE / June 24, 2020, / Compare-autoinsurance.Org has launched a new blog post that presents the main benefits of comparing multiple car insurance quotes. For more info and free online quotes, please visit https://compare-autoinsurance.Org/the-advantages-of-comparing-prices-with-car-insurance-quotes-online/ The modern society has numerous technological advantages. One important advantage is the speed at which information is sent and received. With the help of the internet, the shopping habits of many persons have drastically changed. The car insurance industry hasn't remained untouched by these changes. On the internet, drivers can compare insurance prices and find out which sellers have the best offers. View photos The advantages of comparing online car insurance quotes are the following: Online quotes can be obtained from anywhere and at any time. Unlike physical insurance agencies, websites don't have a specific schedule and they are available at any time. Drivers that have busy working schedules, can compare quotes from anywhere and at any time, even at midnight. Multiple choices. Almost all insurance providers, no matter if they are well-known brands or just local insurers, have an online presence. Online quotes will allow policyholders the chance to discover multiple insurance companies and check their prices. Drivers are no longer required to get quotes from just a few known insurance companies. Also, local and regional insurers can provide lower insurance rates for the same services. Accurate insurance estimates. Online quotes can only be accurate if the customers provide accurate and real info about their car models and driving history. Lying about past driving incidents can make the price estimates to be lower, but when dealing with an insurance company lying to them is useless. Usually, insurance companies will do research about a potential customer before granting him coverage. Online quotes can be sorted easily. Although drivers are recommended to not choose a policy just based on its price, drivers can easily sort quotes by insurance price. Using brokerage websites will allow drivers to get quotes from multiple insurers, thus making the comparison faster and easier. For additional info, money-saving tips, and free car insurance quotes, visit https://compare-autoinsurance.Org/ Compare-autoinsurance.Org is an online provider of life, home, health, and auto insurance quotes. This website is unique because it does not simply stick to one kind of insurance provider, but brings the clients the best deals from many different online insurance carriers. In this way, clients have access to offers from multiple carriers all in one place: this website. On this site, customers have access to quotes for insurance plans from various agencies, such as local or nationwide agencies, brand names insurance companies, etc. "Online quotes can easily help drivers obtain better car insurance deals. All they have to do is to complete an online form with accurate and real info, then compare prices", said Russell Rabichev, Marketing Director of Internet Marketing Company. CONTACT: Company Name: Internet Marketing CompanyPerson for contact Name: Gurgu CPhone Number: (818) 359-3898Email: [email protected]: https://compare-autoinsurance.Org/ SOURCE: Compare-autoinsurance.Org View source version on accesswire.Com:https://www.Accesswire.Com/595055/What-Are-The-Main-Benefits-Of-Comparing-Car-Insurance-Quotes-Online View photos

picture credit

to request, modification Contact us at Here or [email protected]