Uncategorized

Rising earthquake insurance costs put millions of Missouri’s economy at risk | Missouri

(Center Square) — The continued rise in the cost of earthquake insurance is putting millions of Missouri’s residents and its economy at risk, according to a new report from the Missouri Department of Commerce and Insurance (DCI).

The cost of some earthquake insurance policies for homes and businesses has increased 760% over the past 20 years, according to the “2020 Residential Earthquake Coverage in Missouri” report. Some policyholders pay discounts of up to 20% to 25%.

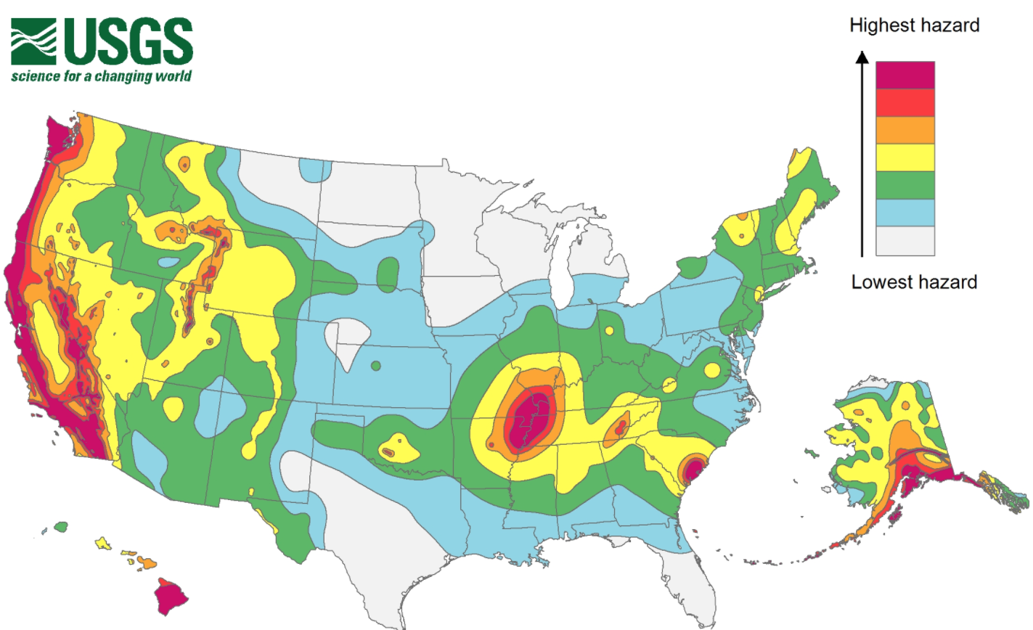

The New Madrid Seismic Zone covers the southeastern quadrant of the state, from the Boot to the Mississippi River to include the entire St. Louis Metropolitan Statistical Area, according to a DCI report. Maps from the Central United States Seismological Consortium (CUSEC) show the area extending into northeastern Arkansas, western Tennessee, Kentucky and southern Illinois.

“We are deeply concerned about the state of Missouri’s earthquake insurance,” Clara Lindley Myers, director of the Global Directorate of Defense, said in a statement announcing the report’s publication. There is a growing gap between the insured and the uninsured in the high-risk area surrounding New Madrid. The cost of earthquake coverage in that area is very expensive and some insurance companies have pulled out entirely. This is a multi-state problem and will require multi-state cooperation to address it.”

Letters requesting comment on the report were sent with the Missouri Insurance Alliance, the Missouri Association of Insurance Agents, and several insurance agents in Southeast Missouri but were not returned.

Insurance companies take into account damages and lives lost after earthquakes in similar amounts. In 1994, a 6.7-magnitude earthquake in Northridge, California, killed 33 people and caused $20 billion in damage, according to the CUSEC website. In 1995, a 6.9-magnitude earthquake in Kobe, Japan, killed 5,500 people and caused $100 billion in damage, according to CUSEC.

CUSEC scientists report that New Madrid is the largest active area in the United States east of the Rocky Mountains. The probability of an earthquake of magnitude 6 or greater in the New Madrid region in any 50-year period is estimated to be between 25-40%. DCI estimates Missouri’s economic loss from a major earthquake to be as high as $300 billion.

“Insurance experts look for information and compare the cost and frequency of events, event locations and predictability,” said Laurie Croy, director of communications at DCI. “One of the problems with earthquakes is that there is no way to accurately predict an earthquake, its intensity, or its timing.”

Insurers have increasingly withdrawn from high-risk areas of the country or implemented more stringent insurance standards. Policyholders self-insure a significant amount through higher discounts and separate discounts for structures and contents.

In the state’s New Madrid area — Mississippi, New Madrid, Pemiscot, Dunklin, Stoddard, and Scott — the percentage of dwellings covered by earthquakes decreased by 47 percentage points between 2000 and 2020, from 60.2 to 12.7%. The cost of earthquake insurance has increased by 102% in the last 10 years in the region.

“Missouri is a unique geological environment in terms of earthquakes,” Crowe said. “And that’s part of the problem.”

A survey of Missouri insurers found that nearly 20% of area policies do not offer coverage with a deduction of less than 25% of the value of the insured property. Less than 2% offer policies with discounts as low as 5%, compared to 43% of earthquake policies in the rest of the state.

In 90 of Missouri’s 116 counties, less than 20% of dwellings have earthquake coverage and only four counties have at least half of the lodgings with earthquake insurance—Cape Girardeau, St. Charles, St. Louis, and Jefferson.

DCI, CUSEC, the Missouri Department of Public Safety, the State Emergency Management and the Federal Emergency Management Agency plan to hold the first “US Earthquake Strategy Summit” in September in St. Louis. “We will invite leading innovators and visionaries to start conversations geared toward solving this critical problem,” said Lindley Myers. “It is imperative that we plan our resilience and recovery strategies before a major seismic event hits the New Madrid region.”

.

|

Sources 2/ https://www.thecentersquare.com/missouri/rising-earthquake-insurance-costs-put-millions-of-missourians-economy-at-risk/article_2b08f1d4-e99d-11eb-b028-b355b0bfef93.html The mention sources can contact us to remove/changing this article |

What Are The Main Benefits Of Comparing Car Insurance Quotes Online

LOS ANGELES, CA / ACCESSWIRE / June 24, 2020, / Compare-autoinsurance.Org has launched a new blog post that presents the main benefits of comparing multiple car insurance quotes. For more info and free online quotes, please visit https://compare-autoinsurance.Org/the-advantages-of-comparing-prices-with-car-insurance-quotes-online/ The modern society has numerous technological advantages. One important advantage is the speed at which information is sent and received. With the help of the internet, the shopping habits of many persons have drastically changed. The car insurance industry hasn't remained untouched by these changes. On the internet, drivers can compare insurance prices and find out which sellers have the best offers. View photos The advantages of comparing online car insurance quotes are the following: Online quotes can be obtained from anywhere and at any time. Unlike physical insurance agencies, websites don't have a specific schedule and they are available at any time. Drivers that have busy working schedules, can compare quotes from anywhere and at any time, even at midnight. Multiple choices. Almost all insurance providers, no matter if they are well-known brands or just local insurers, have an online presence. Online quotes will allow policyholders the chance to discover multiple insurance companies and check their prices. Drivers are no longer required to get quotes from just a few known insurance companies. Also, local and regional insurers can provide lower insurance rates for the same services. Accurate insurance estimates. Online quotes can only be accurate if the customers provide accurate and real info about their car models and driving history. Lying about past driving incidents can make the price estimates to be lower, but when dealing with an insurance company lying to them is useless. Usually, insurance companies will do research about a potential customer before granting him coverage. Online quotes can be sorted easily. Although drivers are recommended to not choose a policy just based on its price, drivers can easily sort quotes by insurance price. Using brokerage websites will allow drivers to get quotes from multiple insurers, thus making the comparison faster and easier. For additional info, money-saving tips, and free car insurance quotes, visit https://compare-autoinsurance.Org/ Compare-autoinsurance.Org is an online provider of life, home, health, and auto insurance quotes. This website is unique because it does not simply stick to one kind of insurance provider, but brings the clients the best deals from many different online insurance carriers. In this way, clients have access to offers from multiple carriers all in one place: this website. On this site, customers have access to quotes for insurance plans from various agencies, such as local or nationwide agencies, brand names insurance companies, etc. "Online quotes can easily help drivers obtain better car insurance deals. All they have to do is to complete an online form with accurate and real info, then compare prices", said Russell Rabichev, Marketing Director of Internet Marketing Company. CONTACT: Company Name: Internet Marketing CompanyPerson for contact Name: Gurgu CPhone Number: (818) 359-3898Email: [email protected]: https://compare-autoinsurance.Org/ SOURCE: Compare-autoinsurance.Org View source version on accesswire.Com:https://www.Accesswire.Com/595055/What-Are-The-Main-Benefits-Of-Comparing-Car-Insurance-Quotes-Online View photos

to request, modification Contact us at Here or [email protected]