Business

Exploring the Tokyo Stock Exchange's Top Three Dividend Stocks with Yields of Up to 3.7%

Amid global market volatility, Japanese stocks have retreated from recent highs, driven by interventions aimed at stabilizing the yen. This dynamic market environment underscores the appeal of dividend stocks, which can offer investors potential stability and consistent returns in times of uncertainty.

Top 10 Dividend Stocks in Japan

|

Name |

Dividend yield |

Dividend Rating |

|

Yamato Kogyo (TSE: 5444) |

3.73% |

|

|

Tsubakimoto Chain (TSE: 6371) |

3.73% |

|

|

Showa-Ota Business Brain (TSE: 9658) |

3.44% |

|

|

Globeride (TSE:7990) |

3.76% |

|

|

FALCO HOLDINGS (TSE:4671) |

6.54% |

|

|

Kurimoto Ltd (TSE: 5602) |

4.30% |

|

|

Nissin (TSE:9066) |

4.38% |

|

|

Gakkyusha Ltd (TSE:9769) |

4.08% |

|

|

Doshisha Ltd (TSE: 7483) |

3.50% |

|

|

Innotech (TSE:9880) |

4.04% |

Click here to see the full list of 385 stocks in our Best Japanese Dividend Stocks Analysis tool.

Let's review some notable picks from our selected stocks.

Simply Wall St Dividend Rating:

Preview: Persol Holdings Co., Ltd. operates globally and provides human resources services under the PERSOL brand, with a market capitalization of approximately $588.16 billion.

Operations: Persol Holdings Co., Ltd. generates revenue through various segments including Career ($128.28 billion), Technology ($102.38 billion), Asia Pacific ($412.77 billion) and Staffing excluding BPO ($575.80 billion).

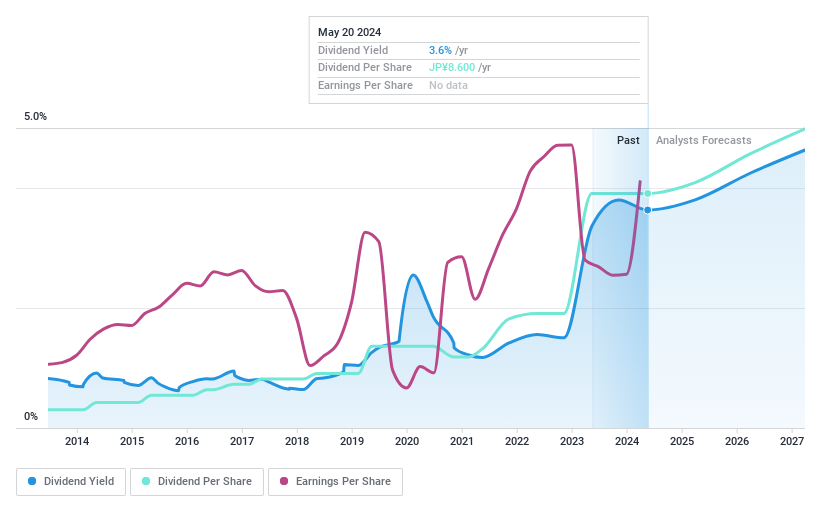

Dividend yield: 3.5%

Persol Holdings Ltd’s dividend yield stands at 3.47%, placing it in the top 25% of Japanese dividend payers. Despite a volatile dividend history over the past decade, recent earnings growth of 45.6% and forecasts for a 12.02% annual increase suggest potential stability ahead. Dividends are well supported by both earnings, with a payout ratio of 65.1%, and cash flow, with a cash payout ratio of 32.8%. The company has also committed to improving shareholder returns through a substantial share buyback program totaling 20 billion, aiming to repurchase up to 5.41% of its shares by March 2025, demonstrating confidence in its financial health and commitment to returning value to shareholders.

Simply Wall St Dividend Rating:

Preview: Bewith, Inc. operates in Japan, offering contact and call center services as well as business process outsourcing (BPO) solutions that leverage digital technologies, with a market capitalization of approximately 29.29 billion.

Operations: Bewith, Inc. generates $38.25 billion in revenue from its digitally-driven call and contact center operations and business process outsourcing services.

Dividend yield: 3.7%

Bewith, Inc. recently increased its dividend from JPY 49.00 to JPY 53.00 per share and anticipates a further increase to JPY 77.00 for the next fiscal year, reflecting a positive trend despite its two-year dividend history. The company's dividends appear sustainable with a payout ratio of 40.4% and are supported by earnings growth projections of 18.48% per year and strong cash flow coverage with a cash payout ratio of 57%. Trading at a significant undervaluation, Bewith offers good relative value in the market.

Simply Wall St Dividend Rating:

Preview: Business Brain Showa-Ota Inc., a Japan-based company, specializes in system development consulting and solutions with a market capitalization of approximately 26.28 billion.

Operations: Business Brain Showa-Ota Inc. generates its revenue primarily from consulting and system development solutions in Japan.

Dividend yield: 3.4%

Business Brain Showa-Ota Inc. offers a solid dividend yield of 3.44%, placing it in the top 25% of Japanese dividend payers. Its dividends are well supported by a low payout ratio of 5.1% and a cash payout ratio of 33%, ensuring sustainability and coverage by both earnings and cash flow. The stock is trading at a 32.9% discount to its estimated fair value, reinforcing its appeal as an investment option despite the company’s significant earnings growth of 669.6% over the past year, suggesting solid financial health and the potential for continued dividend reliability and growth.

Next steps

-

Unlock our full list of 385 Top Japanese Dividend Stocks by clicking here.

-

Do you own shares in these companies? Set up your portfolio in Simply Wall St to transparently track your investments and receive personalized updates on your portfolio's performance.

-

Invest smarter with the free Simply Wall St app that provides in-depth insights into every stock market around the world.

Are you considering other strategies?

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to constitute financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. Our goal is to provide you with focused, long-term analysis based on fundamental data. Please note that our analysis may not factor in the latest price-sensitive company announcements or qualitative information. Simply Wall St has no position in any of the stocks mentioned.

Companies featured in this article include EST: 2181 EST: 9216 And EST: 9658.

Do you have any comments on this article? Are you concerned about its content? Get in touch with us directly. You can also send an email to [email protected]

|

Sources 2/ https://finance.yahoo.com/news/exploring-three-top-dividend-stocks-200810781.html The mention sources can contact us to remove/changing this article |

What Are The Main Benefits Of Comparing Car Insurance Quotes Online

LOS ANGELES, CA / ACCESSWIRE / June 24, 2020, / Compare-autoinsurance.Org has launched a new blog post that presents the main benefits of comparing multiple car insurance quotes. For more info and free online quotes, please visit https://compare-autoinsurance.Org/the-advantages-of-comparing-prices-with-car-insurance-quotes-online/ The modern society has numerous technological advantages. One important advantage is the speed at which information is sent and received. With the help of the internet, the shopping habits of many persons have drastically changed. The car insurance industry hasn't remained untouched by these changes. On the internet, drivers can compare insurance prices and find out which sellers have the best offers. View photos The advantages of comparing online car insurance quotes are the following: Online quotes can be obtained from anywhere and at any time. Unlike physical insurance agencies, websites don't have a specific schedule and they are available at any time. Drivers that have busy working schedules, can compare quotes from anywhere and at any time, even at midnight. Multiple choices. Almost all insurance providers, no matter if they are well-known brands or just local insurers, have an online presence. Online quotes will allow policyholders the chance to discover multiple insurance companies and check their prices. Drivers are no longer required to get quotes from just a few known insurance companies. Also, local and regional insurers can provide lower insurance rates for the same services. Accurate insurance estimates. Online quotes can only be accurate if the customers provide accurate and real info about their car models and driving history. Lying about past driving incidents can make the price estimates to be lower, but when dealing with an insurance company lying to them is useless. Usually, insurance companies will do research about a potential customer before granting him coverage. Online quotes can be sorted easily. Although drivers are recommended to not choose a policy just based on its price, drivers can easily sort quotes by insurance price. Using brokerage websites will allow drivers to get quotes from multiple insurers, thus making the comparison faster and easier. For additional info, money-saving tips, and free car insurance quotes, visit https://compare-autoinsurance.Org/ Compare-autoinsurance.Org is an online provider of life, home, health, and auto insurance quotes. This website is unique because it does not simply stick to one kind of insurance provider, but brings the clients the best deals from many different online insurance carriers. In this way, clients have access to offers from multiple carriers all in one place: this website. On this site, customers have access to quotes for insurance plans from various agencies, such as local or nationwide agencies, brand names insurance companies, etc. "Online quotes can easily help drivers obtain better car insurance deals. All they have to do is to complete an online form with accurate and real info, then compare prices", said Russell Rabichev, Marketing Director of Internet Marketing Company. CONTACT: Company Name: Internet Marketing CompanyPerson for contact Name: Gurgu CPhone Number: (818) 359-3898Email: [email protected]: https://compare-autoinsurance.Org/ SOURCE: Compare-autoinsurance.Org View source version on accesswire.Com:https://www.Accesswire.Com/595055/What-Are-The-Main-Benefits-Of-Comparing-Car-Insurance-Quotes-Online View photos

to request, modification Contact us at Here or [email protected]