Business

Pressure is on for Powell and the Federal Reserve to handle the exit from super-easy policies

Federal Reserve Chairman Jerome Powell testifies during a hearing of the United States House Oversight and Reform Subcommittee on the coronavirus crisis, on Capitol Hill in Washington, June 22, 2021.

Graeme Jennings | Swimming pool | Reuters

For the Federal Reserve, implementing the simplest monetary policy in the institution’s history was difficult enough. Going out won’t be a treat either.

This is what the central bank faces on its way.

On Friday, investors will learn more about what Fed Chairman Jerome Powell thinks about the economy. They also expect to get at least some more clues as to how it will guide the central bank’s exit from the measures it has taken to save the country’s economy from the Covid-19 pandemic. He will be speaking at the Fed’s annual Jackson Hole conference, which will be held virtually again this year.

The first on the role of the Fed is to withdraw money by printing the roughly $ 120 billion in bonds it buys each month to stimulate demand and lower long-term interest rates.

After that, the road becomes more difficult.

At some point, the Fed will look to raise short-term interest rates from the near zero anchor point where they have been since March 2020. The return to normal rates did not end well for the Fed the last time she tried to do so. therefore from 2015-18, because it had to stop mid-cycle in a context of economic slowdown.

Therefore, the markets could be excused for being at least a little nervous this time around. The Fed not only needs to reverse its most aggressive easing policies ever, it needs to do so with precision and hopes not to break anything in the process.

“Every change in the Fed’s monetary policy is important,” said Priya Misra, global head of rate strategy at TD Securities. “But I think it’s especially significant today because we know growth is slowing and the Fed is trying to pull out.”

Indeed, the economy is still well in a strong recovery from the depths of the pandemic, which resulted in the steepest but shortest recession in U.S. history. But the rebound seemed to at least stall. The Citi Economic Surprise Index, which measures actual data against Wall Street estimates, hit an all-time high in mid-July. But the index has now fallen to levels last seen in June 2020.

Fed officials themselves expect significantly slower growth in the coming years at a time when monetary and fiscal policies will be tighter. This raises more questions about whether Powell and his cohorts can get the right exit.

Doubts in the market

“Are they coming out in the right place? Are they coming out at the right time, at the right scale? Given the downturn in the economy, we have questions on both, ”Misra said. “The market is pricing a policy error.”

What Misra means by policy error is that the current pricing of federal funds futures in the market that trades around Fed rate moves indicates that the Fed’s central bank will not be able to raise its rate. that a few times up to maybe 1.25%. Then it will have to stop because the growth stalls.

Such low rates frighten Fed officials as they leave them little leeway to ease policy in times of crisis. This was roughly where the funds rate was at the start of the pandemic crisis, down substantially from the 2.25% to 2.5% target range where the Fed ended its last round of hikes. rates in December 2018.

The calculation of how to manage all of this will be up to Powell from a communications standpoint and the rest of the Federal Open Market Committee in terms of the actual mechanics.

“The tapering is important because it is a very good measure of not only the credibility of the Fed, but in terms of communication, the quality of the strategy and its transparency,” said Deepak Puri, director of investments for Americas at Deutsche Bank Wealth. Management. “In 2013, the Fed made mistakes in the way it communicated on tapering.”

This 2013 episode, called Taper Tantrum, as it’s known now, is the only model the market has on how the Fed might proceed.

TD Securities Misra pointed out that the Fed was already showing that it had learned a lesson from the previous episode by facilitating the crumbling of the market. The 2013 proclamation by then Fed Chairman Ben Bernanke was seen as blunt, and it pushed interest rates and stocks down for several months.

“They do a good job in the sense that they really try not to surprise the markets. It avoids a mistake they made in 2013. It’s positive,” said Shawn Snyder, head of investment strategy at Citi US Consumer Wealth Management. . “They are in a bit of a difficult position because the delta variant acts like a wildcard.”

According to the Fed

The Fed and the markets have been hip joints for a long time, but especially in the era of quantitative easing and zero interest rates that began in 2008. Stocks collapsed sharply at the start of the pandemic, but then rebounded as soon as the Fed skyrocketed. until the purchase of bonds.

The market recouped its losses after the first tap started, and continued to climb through the rate hike cycle until the end of 2018, when a series of communications missteps from Powell shook markets. investors.

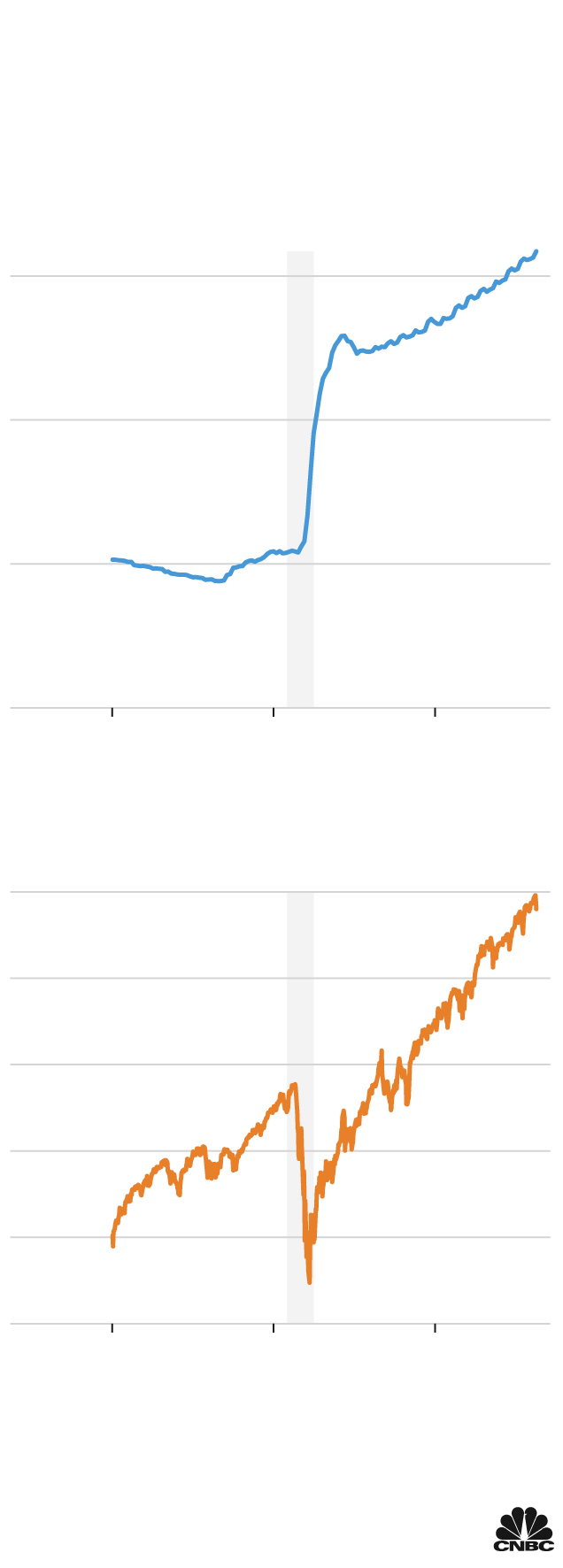

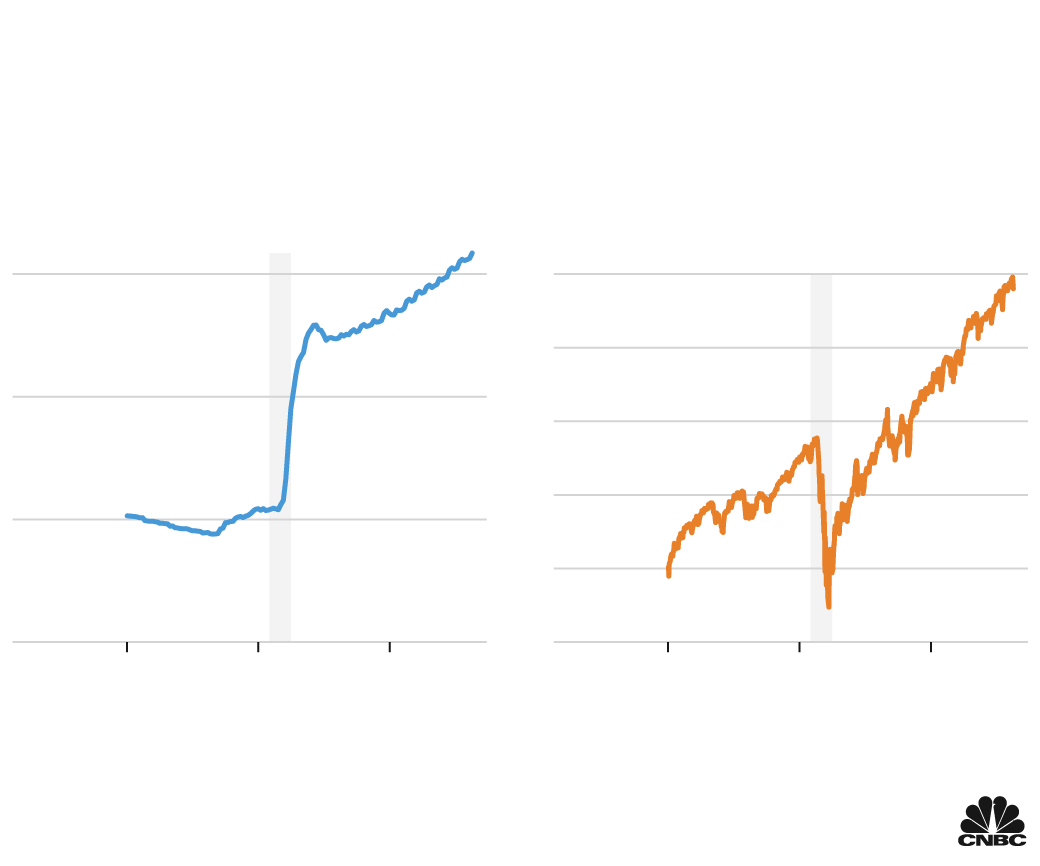

Balance sheet of the Fed, the stock market takes off

As the Federal Reserve builds its balance sheet, the S&P 500 index rebounded

of the Covid crash to reach record levels

Total Federal Reserve Assets

Note: The shaded area represents the recession in the United States. The Fed’s balance sheet data is not adjusted.

Source: Board of Governors of the Federal Reserve System, via the Federal Reserve Bank of St. Louis

(assets), FactSet (S&P 500). Data as of August 18, 2021.

Fed balance sheet, stocks take off

As the Federal Reserve built up its balance

leaf, the S&P 500 index rebounded

of the Covid crash to reach record levels

Total Federal Reserve Assets

Note: The shaded area represents the recession in the United States. fed

balance sheet data are not adjusted.

Source: Federal Reserve Board of Governors

System, via the Federal Reserve Bank of Saint-Louis

(assets), FactSet (S&P 500). Data as of 08/18/21.

Balance sheet of the Fed, the stock market takes off

As the Federal Reserve built its balance sheet, the S&P 500 Index

rebounded from Covid crash to record highs

Total Federal Reserve Assets

Note: The shaded area represents the recession in the United States. The Fed’s balance sheet data is not adjusted.

Source: Board of Governors of the Federal Reserve System, via the Federal Reserve

Bank of Saint-Louis (assets), FactSet (S&P 500). Data as of August 18, 2021.

On the economy, Fed officials have placed less emphasis on their policies and more on tax assistance and the trajectory of the virus.

The Covid-19 casts doubt on the direction of growth. Corn several regional Fed chairmen who spoke to CNBC this week said the virus appears to have little impact on growth and so far is not weighing on their economic forecasts.

“Consumers and businesses are becoming more adaptable, more resilient, and I think people expect that [the virus] is going to go in spurts, ”said Dallas Fed Chairman Robert Kaplan, one of those in favor of a quick but slow removal from the policy.

The informal consensus now in the market is that the Fed will start slowing down before the end of the year and complete the process in eight to 10 months. After that, it will assess where things stand before moving on to rates.

Landmines for Powell

Tricky political dynamics inside and outside the Fed complicate things for Powell.

The growing hawkish tendency of regional presidents such as Kaplan and James Bullard at the St. Louis Fed is clashing with more conciliatory members such as Gov. Lael Brainard and San Francisco Fed President Mary Daly.

On top of that, Powell is running for a new appointment in February, as are several other Fed officials, and President Joe Biden has yet to make his preferences known. Powell already knows what it’s like to lean to keep rates low after his experience with former President Donald Trump. But to some extent, he will still have to keep cats to maintain a Fed consensus as economic and pandemic conditions change.

An image of US President Joe Biden is shown on a screen after his address to the nation regarding the situation in Afghanistan as traders work in the trading floor of the New York Stock Exchange (NYSE) in Manhattan, New York, United States Emirates, August 17, 2021.

Andrew Kelly | Reuters

“The concern for the Fed and the economy is the danger of exerting political pressure to achieve the desired results on the political spectrum, and thus undermining the independence of the Fed,” the former told CNBC. Philadelphia Fed Chairman Charles Plosser in a broadcast interview. “Powell is in a tricky place.”

For his part, Powell used his 2020 Jackson Hole speech to describe a sea change in policy regarding the way the Fed views inflation. The new framework reflects a desire to achieve full inclusive employment, even if this implies high inflation. Politics has been blamed in some neighborhoods for soaring prices this year.

“We are in a period when monetary and fiscal policy is at its most stimulating level that we have seen in 75 years,” Plosser said. “They have to ask themselves what role does politics play in making this inflation more persistent than it would otherwise be.”

Powell’s speech on Friday is unlikely to result in such major breakthroughs in the Fed’s approach, instead focusing on current and future expected conditions with a small clue as to how policymakers will try to manage everything.

But that will likely set the stage for the central bank to return to normal, so the pressure will still be there.

“The real question for me is what will happen next year,” said Snyder of Citi. “Have we ended up looking at moderation in the economy and inflation, which will make it difficult for the Fed to get rates off the ground? I think people are very worried about it. that it may not work as we expected. “

Become a smarter investor with CNBC Pro.

Get stock picks, analyst calls, exclusive interviews, and access to CNBC TV.

Register to start a free trial today.

|

Sources 2/ https://www.cnbc.com/2021/08/26/the-pressure-is-on-for-powell-and-the-federal-reserve-to-manage-the-exit-from-ultra-easy-policies.html The mention sources can contact us to remove/changing this article |

What Are The Main Benefits Of Comparing Car Insurance Quotes Online

LOS ANGELES, CA / ACCESSWIRE / June 24, 2020, / Compare-autoinsurance.Org has launched a new blog post that presents the main benefits of comparing multiple car insurance quotes. For more info and free online quotes, please visit https://compare-autoinsurance.Org/the-advantages-of-comparing-prices-with-car-insurance-quotes-online/ The modern society has numerous technological advantages. One important advantage is the speed at which information is sent and received. With the help of the internet, the shopping habits of many persons have drastically changed. The car insurance industry hasn't remained untouched by these changes. On the internet, drivers can compare insurance prices and find out which sellers have the best offers. View photos The advantages of comparing online car insurance quotes are the following: Online quotes can be obtained from anywhere and at any time. Unlike physical insurance agencies, websites don't have a specific schedule and they are available at any time. Drivers that have busy working schedules, can compare quotes from anywhere and at any time, even at midnight. Multiple choices. Almost all insurance providers, no matter if they are well-known brands or just local insurers, have an online presence. Online quotes will allow policyholders the chance to discover multiple insurance companies and check their prices. Drivers are no longer required to get quotes from just a few known insurance companies. Also, local and regional insurers can provide lower insurance rates for the same services. Accurate insurance estimates. Online quotes can only be accurate if the customers provide accurate and real info about their car models and driving history. Lying about past driving incidents can make the price estimates to be lower, but when dealing with an insurance company lying to them is useless. Usually, insurance companies will do research about a potential customer before granting him coverage. Online quotes can be sorted easily. Although drivers are recommended to not choose a policy just based on its price, drivers can easily sort quotes by insurance price. Using brokerage websites will allow drivers to get quotes from multiple insurers, thus making the comparison faster and easier. For additional info, money-saving tips, and free car insurance quotes, visit https://compare-autoinsurance.Org/ Compare-autoinsurance.Org is an online provider of life, home, health, and auto insurance quotes. This website is unique because it does not simply stick to one kind of insurance provider, but brings the clients the best deals from many different online insurance carriers. In this way, clients have access to offers from multiple carriers all in one place: this website. On this site, customers have access to quotes for insurance plans from various agencies, such as local or nationwide agencies, brand names insurance companies, etc. "Online quotes can easily help drivers obtain better car insurance deals. All they have to do is to complete an online form with accurate and real info, then compare prices", said Russell Rabichev, Marketing Director of Internet Marketing Company. CONTACT: Company Name: Internet Marketing CompanyPerson for contact Name: Gurgu CPhone Number: (818) 359-3898Email: [email protected]: https://compare-autoinsurance.Org/ SOURCE: Compare-autoinsurance.Org View source version on accesswire.Com:https://www.Accesswire.Com/595055/What-Are-The-Main-Benefits-Of-Comparing-Car-Insurance-Quotes-Online View photos

to request, modification Contact us at Here or [email protected]