In his State of the Union address, President Biden proposed giving Medicare the ability to negotiate low prices for prescription drugs.

I think that the president means not only the over-the-counter drug of Part D but also the drug administered at the clinic of Part B. Medicare is an urgent need for that ability. Medicare’s decision to limit the scope of aducanumab to clinical trials will keep costs down for some time, but the bigger problem is: effective A drug for early Alzheimer’s disease in an environment where Medicare does not have the ability to negotiate prices.

read: You may have missed Biden’s mention of Medicare in the State of the Union address, but it can be life-changing for many.

Biogen

BIIB,

-0.82%

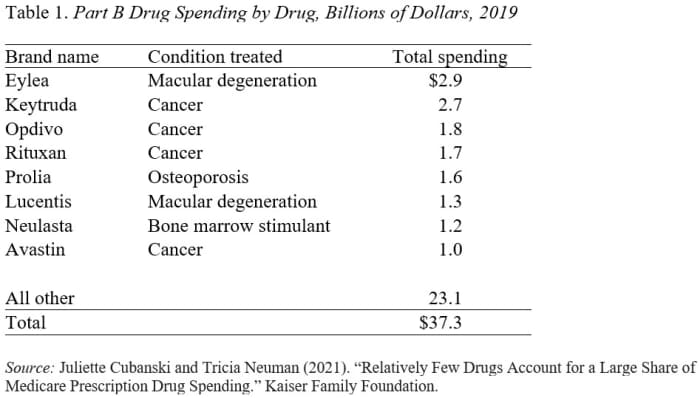

The initial price was $ 56,000 for Aduhelm, It lowered the priceTo $ 28,200 in response to sluggish sales. Even with a million beneficiaries priced at $ 28,200, Medicare will be billed at $ 23 billion (Medicare pays 80% and beneficiaries pay 20% out-of-pocket). Aducanumab spends about two-thirds of what Medicare Apartment B currently spends on all medicines, eight times the amount currently spent on the most expensive medicine, Eylea (Table 1). reference).

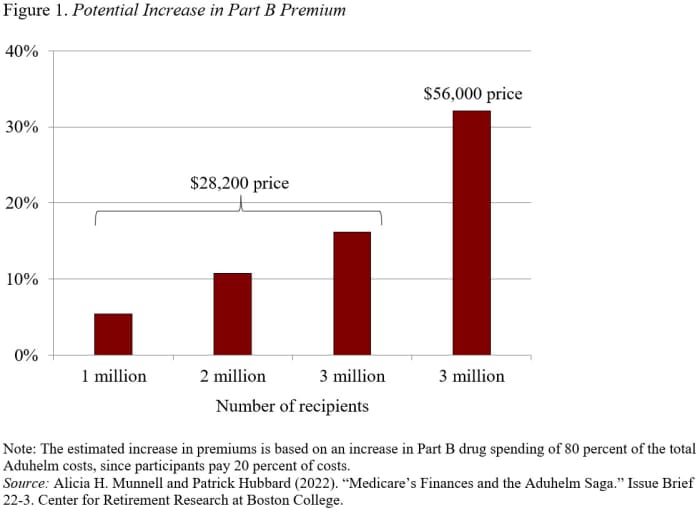

With total spending of Medicare Apartment B of $ 419 billion in 2020, an increase of $ 23 billion would require a 5.4% increase in Part B premiums. These costs increase over time as individuals with Alzheimer’s disease become eligible. It could also double if a competitor offers a clearly effective product at Biogen’s original price of $ 56,000. Due to the increased number of eligible patients and the initial price of Biogen, it may eventually be necessary to raise Part B premiums by 32% (see Figure 1).

Patients with Alzheimer’s disease will have to pay a high out-of-pocket cost for both the drug and related medical services (such as regular MRI scans) because the beneficiaries usually pay 20% co-insurance. Therefore, even with a “discounted price” of $ 28,200, the beneficiary will pay $ 5,640 for a year’s supply of Aduhelm. At the original $ 56,000 price, joint insurance was $ 11,200. Traditional beneficiaries without Medigap policies face direct costs. If you have adopted the Medigap policy, your insurance premiums will increase. Members of the Medicare Advantage Plan will also be responsible for sharing costs until the annual out-of-pocket limit is reached. All of these increased spending will have a devastating impact on the typical Medicare beneficiaries with an average income of about $ 30,000. And, as mentioned earlier, aducanumab is not a cure, and patients may bear these costs for years.

read: Medicare Finances and Alzheimer’s Disease Drug Aducanumab Story

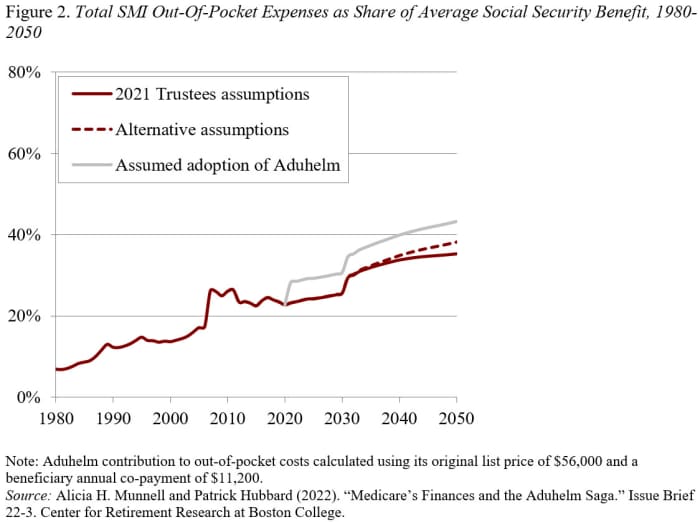

The increase in Part B premiums and co-insurance from aducanumab would have significantly increased the average out-of-pocket costs as part of the average social security benefits. These costs now reach about 25% of the average social security benefit and will rise to 35% by 2050 under the 2021 trustee assumption and 38% under the alternative assumption (Figure 2). reference).

read: How the Alzheimer’s disease drug Aduhlem raised real problems with Medicare authorities

If Medicare approves Aduhelm for the original price of $ 56,000 and ultimately 3 million beneficiaries qualify for the drug, the expected out-of-pocket cost will be the average social security benefit by 2050. It is equivalent to 43%. Of course, at some point the patent will expire. With the advent of generic drugs, you will have some control over the prices of drug creators.

Obviously, the goal of society is to mitigate the damage of horrific illnesses, but the story of aducanumab is the financial risk of the system if valuable medicines become available and Medicare remains unable to negotiate prices. Is emphasized. Hopefully, the story of aducanumab will rekindle Congress’s interest in empowering Medicare to negotiate drug prices.

|

Sources

1/ https://Google.com/

2/ https://www.marketwatch.com/story/as-president-biden-proposed-medicare-needs-the-ability-to-negotiate-drug-prices-11646674847

The mention sources can contact us to remove/changing this article

|

What Are The Main Benefits Of Comparing Car Insurance Quotes Online

LOS ANGELES, CA / ACCESSWIRE / June 24, 2020, / Compare-autoinsurance.Org has launched a new blog post that presents the main benefits of comparing multiple car insurance quotes. For more info and free online quotes, please visit https://compare-autoinsurance.Org/the-advantages-of-comparing-prices-with-car-insurance-quotes-online/ The modern society has numerous technological advantages. One important advantage is the speed at which information is sent and received. With the help of the internet, the shopping habits of many persons have drastically changed. The car insurance industry hasn't remained untouched by these changes. On the internet, drivers can compare insurance prices and find out which sellers have the best offers. View photos The advantages of comparing online car insurance quotes are the following: Online quotes can be obtained from anywhere and at any time. Unlike physical insurance agencies, websites don't have a specific schedule and they are available at any time. Drivers that have busy working schedules, can compare quotes from anywhere and at any time, even at midnight. Multiple choices. Almost all insurance providers, no matter if they are well-known brands or just local insurers, have an online presence. Online quotes will allow policyholders the chance to discover multiple insurance companies and check their prices. Drivers are no longer required to get quotes from just a few known insurance companies. Also, local and regional insurers can provide lower insurance rates for the same services. Accurate insurance estimates. Online quotes can only be accurate if the customers provide accurate and real info about their car models and driving history. Lying about past driving incidents can make the price estimates to be lower, but when dealing with an insurance company lying to them is useless. Usually, insurance companies will do research about a potential customer before granting him coverage. Online quotes can be sorted easily. Although drivers are recommended to not choose a policy just based on its price, drivers can easily sort quotes by insurance price. Using brokerage websites will allow drivers to get quotes from multiple insurers, thus making the comparison faster and easier. For additional info, money-saving tips, and free car insurance quotes, visit https://compare-autoinsurance.Org/ Compare-autoinsurance.Org is an online provider of life, home, health, and auto insurance quotes. This website is unique because it does not simply stick to one kind of insurance provider, but brings the clients the best deals from many different online insurance carriers. In this way, clients have access to offers from multiple carriers all in one place: this website. On this site, customers have access to quotes for insurance plans from various agencies, such as local or nationwide agencies, brand names insurance companies, etc. "Online quotes can easily help drivers obtain better car insurance deals. All they have to do is to complete an online form with accurate and real info, then compare prices", said Russell Rabichev, Marketing Director of Internet Marketing Company. CONTACT: Company Name: Internet Marketing CompanyPerson for contact Name: Gurgu CPhone Number: (818) 359-3898Email: [email protected]: https://compare-autoinsurance.Org/ SOURCE: Compare-autoinsurance.Org View source version on accesswire.Com:https://www.Accesswire.Com/595055/What-Are-The-Main-Benefits-Of-Comparing-Car-Insurance-Quotes-Online View photos

Related